𝗦𝗘𝗖 𝗮𝗽𝗽𝗿𝗼𝘃𝗲𝘀 𝘀𝗮𝗻𝗱𝗯𝗼𝘅 𝗮𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀 𝗼𝗳 𝗣𝗹𝘂𝗮𝗻𝗴 𝗣𝗛, 𝗚𝗖𝗮𝘀𝗵

The Securities and Exchange Commission (SEC) has approved the applications of Macodimarc Technology Corporation (Pluang PH) and G-Xchange, Inc. (GCash) to participate in the Commission’s regulatory sandbox.

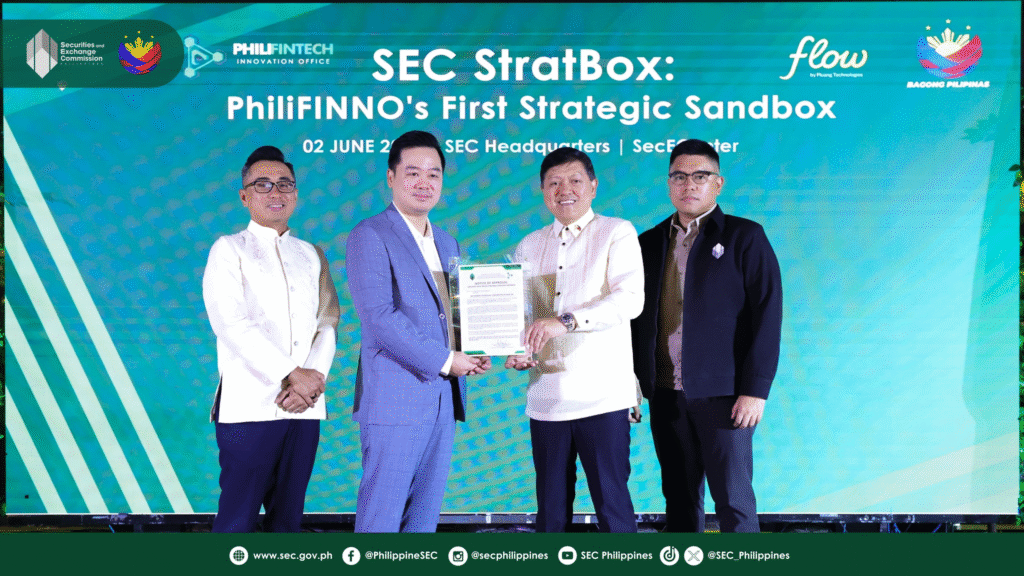

The SEC on June 2 formally issued the Notice of Approval for Entry into the SEC Strategic Sandbox (StratBox) to Pluang PH and GCash, allowing them to pilot their platforms in a limited regulatory environment.

Implemented through SEC Memorandum Circular No. 9, Series of 2024, the SEC StratBox is a regulatory sandbox that allows firms to test innovative products or services in a live but controlled setting, with the goal of eventually offering them to the public at large.

The SEC may also grant regulatory reliefs to sandbox participants by modifying or replacing specific licensing, registration, compliance, or other regulatory requirements that may otherwise apply, during the sandbox period, according to the framework.

Information technology firm Pluang PH will test a mobile application that will allow retail investors in the country to trade and invest in U.S. securities, which have been pre-selected by the applicant and pre-approved by the SEC.

These securities are listed in the New York Stock Exchange and/or National Association of Securities Dealers Automated Quotations.

The sandbox of Pluang PH will run for six months, and will involve a controlled group of up to 1,000 qualified buyers and retail users.

Meanwhile, GCash will seek to provide simplified and unified access to global stock markets within its application through GStocks Global.

The duration of the sandbox period will be for 24 months, and can admit up to a total of 2 million participants.

GCash and Pluang PH are required to provide the SEC with regular updates, detailing the progress of their operations, testing outcomes, and issues encountered.

Leave a Comment