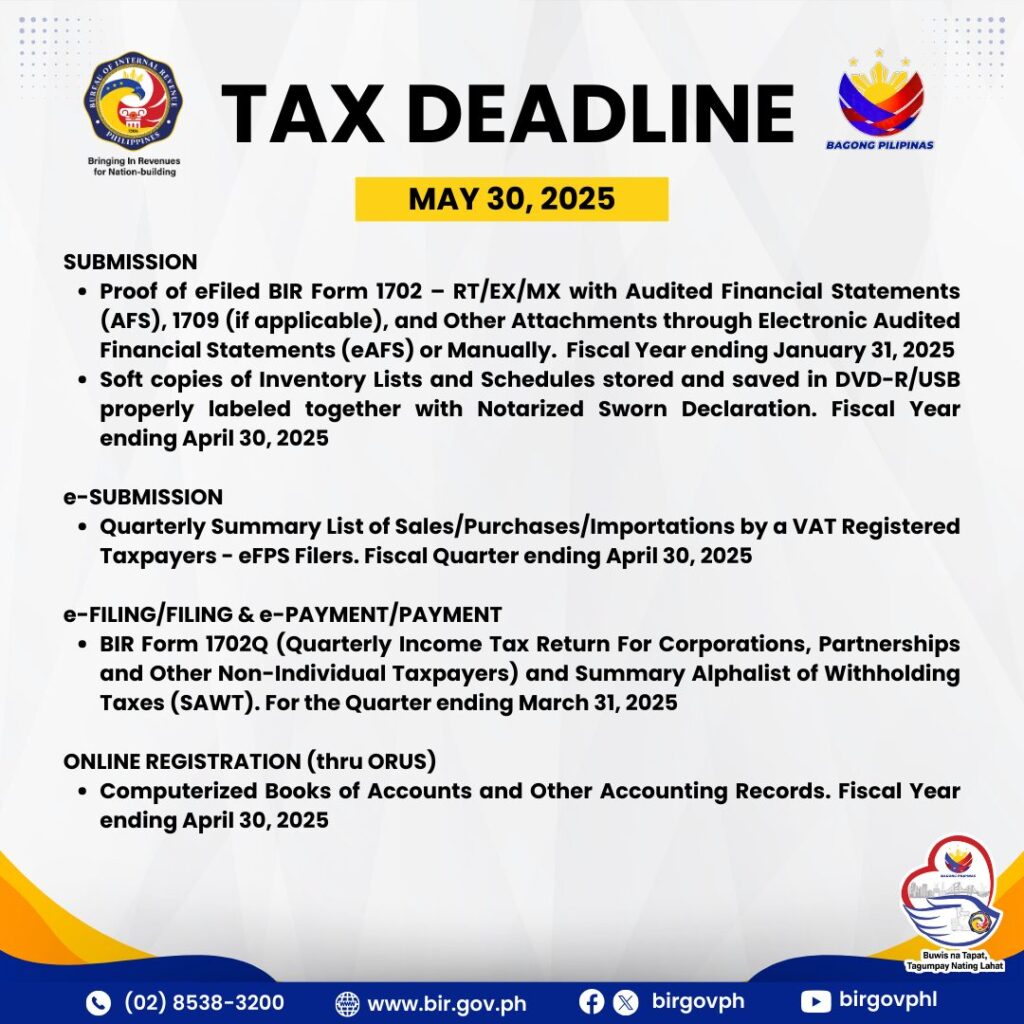

BIR TAX DEADLINE

SUBMISSION

Proof of eFiled BIR Form 1702 – RT/EX/MX with Audited Financial Statements (AFS), 1709 (if applicable), and Other Attachments through Electronic Audited Financial Statements (eAFS) or Manually. Fiscal Year ending January 31, 2025

Soft copies of Inventory Lists and Schedules stored and saved in DVD-R/USB properly labeled together with Notarized Sworn Declaration. Fiscal Year ending April 30, 2025

e-SUBMISSION

Quarterly Summary List of Sales/Purchases/Importations by a VAT Registered Taxpayers – eFPS Filers. Fiscal Quarter ending April 30, 2025

e-FILING/FILING & e-PAYMENT/PAYMENT

BIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers) and Summary Alphalist of Withholding Taxes (SAWT). For the Quarter ending March 31, 2025

ONLINE REGISTRATION (thru ORUS)

Computerized Books of Accounts and Other Accounting Records. Fiscal Year ending April 30, 2025

Leave a Comment